It is a fractal of the ride up into the xmas high. Looking for retest of annual pivot or interim support line, most likely 1.3560. Reversal pattern required but longs not an option for me unless 1.3745 holds after solid retracement.

Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Friday 28 February 2014

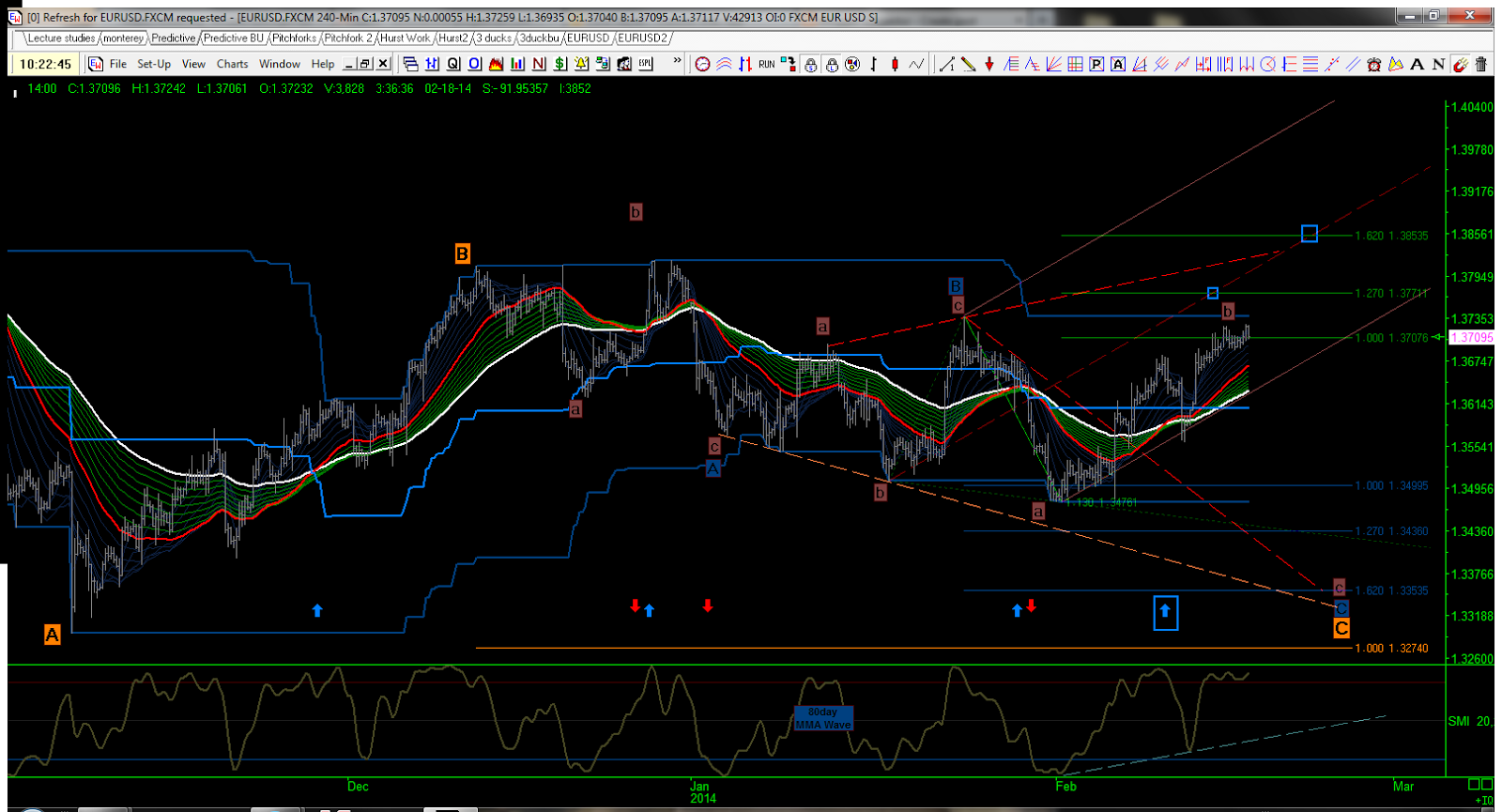

EURUSD

So much for my day of rest! I am going to be nibbling in shorts every 25 pips or so: the FLD chart has a very clear 40 day trough below, and although we have just had a combined 20/40day FLD bounce that went according to plan like a dream, I am now looking for the next move. See how price is moving into the daily bollys again at the 1.3818 square root progression calc - these bollys have been tweaked a bit to make them harder to reach (not SD of close!) - so I reckon the 40day trough is going to either cause a diagonal to build above or a drop. Either way, I am selling relative highs from here.

EURUSD

I have re-jigged the count a little to take out the expanding diagonal and add in an expanding flat. I think the 162% extension makes a lot of sense in testing the 1.3892 high from Christmas and keeps the red dashed trend line in play too. Not much different, but helping me focus on that target if we can see a push past 1.3745.

Now, I might be ill, but them dogs still need walking and it is absolutely chucking it down outside with rain - great!

Now, I might be ill, but them dogs still need walking and it is absolutely chucking it down outside with rain - great!

EURUSD

I am ridden with flu this morning and will keep the post brief. Price bounced from the SMA confluence with the 20/40day FLDs yesterday and is now sat under the 5/10 & 80day FLDs having 'cut' the 160d.fld to the upside. I have moved my breakeven to just under the daily pivot, which has already been tested this morning, and hope for a breakout above. Targeting 1.3818 to 1.3850. As long as price stays above the orange 20day FLD, I am trying to stay long as the 80day cycle is still bullish.

Thursday 27 February 2014

EURUSD

Taken the opportunity to bank a few more shorts with the 4hr momentum cluster making positive divergence suggestions. The 5day, 10day & 80 day FLDs are all sat together at 1.3745 (a square root progression number off 1.3892 and 1.2041), and a successful break of the golden 160d.fld, should see an attempt at this zone at least. Looking for this 20day/40day zone to hold here, as recall it also holds the 20,50 & 100 day SMAs - see yesterday's posts.

EURUSD

I have my longs covered directly under yesterday's low, but looking for the 160d.FLD to break to the upside, based on the placement of the momentum study. Whether or not, the 20d & 40d.flds have had enough of look in thus far, is the question, but a break above the gold FLD is likely to see price push back on the 80d.FLD above with renewed passion. The MMA wave has the 80day (green line) still above the thin gold 160day

trend, so if the above comes to pass, we will have confirmation for

now that the 80day trend is still in command, which is why a break of

the blue 80d.fld would be interesting at this stage of the momentum

study.

Wednesday 26 February 2014

EURUSD

With the 20 & 40 day FLDs pretty well backtested, any trip back north through the 160day FLD, will leave the 80day FLD with all the permissions it needs to progress uphill - see last post. This is the count I am running with for a longer 'e' leg in my 'B' diagonal and likely to follow a contracting diagonal into the close. May as work it right up to the 1.3892 high, but will be flat well before that!!

EURUSD

This is getting very close to my target zone from earlier today (and all week!), so I am edging net long here and will look to build a greater position if the drop moves my remaining shorts into profit.

EURUSD

Well, that is more like it, but I have banked half the shorts and gone flat. 2 reasons really. Firstly, the half banked was a good amount of money in real terms and this has been an awfully slow consolidation. Secondly, that 2hr momentum study is already looking oversold and if this is not 'the one' then the bounce could be spikey to set up the real one. So, although somewhat defeatist and possibly trigger happy, I am flat and hoping for more, but from higher up. As such, a bounce from the gold 160day FLD would be great but quite happy to bank more shorts nearer the 20/40day FLD combo lower down, if price continues to fall.

EURUSD

Yesterday's chart was a stripped down version of today's. Just wanted to keep the SMA cluster in mind - we have the 20,50 & 100 day SMAs, all in the 1.3620-1.3650 zone, along with the 20 & 40day FLDs - see red sidewards arrow in main chart. I'll not be betting on a 'cut' here and will bank all shorts or cover as price approaches (if it does!). The market sees the triangle that has been building of late, but unless last week's high is taken out, I am short and hopeful, whilst my trend indicators show the 5x10 & 10x20day trends are bearish (sub chart)..

Tuesday 25 February 2014

EURUSD: zooming out

Keeping focused on the bigger picture can be a little testing when matters are apparently so slow, but I keep moving in and out of time frames until I can find a storyboard that makes sense to me. This 2hr chart just about keeps all the relevant facts on one page: the MMA wave is comprised of the 80day trend and its 100% extension at 160day and then again at 320day. This MMA wave is currently in a bearish formation, but has been under attack from a bullish 80 day trend since the 1.3476 low, with price sat on top of that wave at present. However, if you tease that MMA wave apart into its derivative parts (so, 20,40,80,160,320 day trends) and then shift each one forward by half of their length (I use half or double of everything to create a sequence ladder), you get a maze of future decision points for price to work through. Troughs and Peaks and the lines themselves are viewed as possible zones to attract price, depending on whether larger cycles are working with or against the trend in question. So, for example, this bullish 80day trend, is making it hard work for the price to move down towards the 20 or 40day FLDs, illustrated by prices stickiness to the 80day & 160day FLDs. However, as I say, the 160x320day trend is still down and if the 160day FLD can get 'cut' to the downside, not only will the 20day and 40day FLDs get hit in quick succession, but where the hell is that 320day FLD?

I have been posting my EW count on the 48 pip range bar study because it strips out time and leaves tighter looking patterns (for good or for bad!). The 320day FLD from the first chart, is spot on with my count as it would be, because the Hurst model came first. We humans do love a good story, but will mine get a chance to shine?

I have been posting my EW count on the 48 pip range bar study because it strips out time and leaves tighter looking patterns (for good or for bad!). The 320day FLD from the first chart, is spot on with my count as it would be, because the Hurst model came first. We humans do love a good story, but will mine get a chance to shine?

EURUSD

The break through the blue daily & purple 5day FLD this morning followed the backtest of the red 10day FLD yesterday, which was also yesterday's low. I have banked my longs from last night on the approach to yesterday's high and will re-engage if the high gets taken out from last week's high (1.3772).

With the 20day trend (see sub chart) still negative, and with the 80day low (see weekend report) due at the end of the month, I am keeping to the short program until that 20 day FLD (orange ) is hit.

The manner in which that eventual move pans out, will help to decypher this mess, which for now looks like a diagonal - see the range bar study below.

With the 20day trend (see sub chart) still negative, and with the 80day low (see weekend report) due at the end of the month, I am keeping to the short program until that 20 day FLD (orange ) is hit.

The manner in which that eventual move pans out, will help to decypher this mess, which for now looks like a diagonal - see the range bar study below.

Monday 24 February 2014

eurusd

It looks like I missed the opportunity to bank more shorts today, but can not teach and trade at the same time! Looks like it wants to move up to the next square root progression line at 1.3818, which is also the weekly pivot R2 this week and the daily bolly roof. The momentum study suggests we are in a 'b' wave here, so I have gone completely flat and I'll look to bank longs higher or shorts lower - but right now, flat.

Sunday 23 February 2014

EURUSD - weekend review

I'll be in lectures until tomorrow evening, so a summary now and I'll probably be off air until Tuesday.

Cyclic Phasing: always assuming that my interpretation is correct of course, I have the 80 trading day low coming for the end of the month. The only 10day cycle within that, that did not come in almost to the day, was the 7th, which was early. So, I am looking for an 8th 10day low to conclude this 80day cycle which has spent half going up and the 2nd half going sidewards. The Raff Regression channel from the last 80 day low has its LTL at just below the annual pivot (1.3476) and a touch there would be a neat to say the least. This would mean price 'cutting' the 20 day FLD (orange) to reach down to the VTL (pink dashed) also sat at the annual pivot (white dashed) or the Harmonic line at 1.34375. I don't really mind how far price pushes downhill, as I am net short, but catching the lift up the other side might be very rewarding indeed.

The 5x10 & 10x20 day trends were negative on Friday, notwithstanding the recovery late on, (see 1st sub-chart) with price hovering above the 80day FLD and the 160day sat right underneath. The placement of the 80day FLD is the key anchor point for me, once I am confident the 80day cyclic low is in place. The further away price can be from the FLD, at its cyclic low, the more punch I'll get for my risk long later. A move down through the 80day & 160day FLD this week, should zip through to the 20day & 40 day FLDs with no issues whatsoever (being half way points of smaller cycles) and I think that daily bolly band and 200dsma look just peachy for a realistic eventual target. The question I ask, is where the market would want to be before committing long and that seems to be a great supply zone to me. Will it get there is not up to me!!

Moving into the 30min chart and we can see that price action created an inside day, Friday. The 1-5day trends were all positive at the close, but price was being capped by the weekly FLD, with the daily and 2 weekly FLDs below the daily pivot. There was enough potential in the 4hr momentum studies for me to cover half my shorts at the close, although I hope to lose them for a small gain or BE before any move downhill gets going. Generally, I am looking for a move down to the 20day FLD at the bottom of the chart and that then to get 'cut' to the downside, to mark the half way point in a move down to the 1.3476 area (hope!!).

As matters stood Friday, the Range Bar Studies all remained bullish, albeit they are derivatives of each other of course. What I am looking for is a push down in the 48pip RBS with a nested low in the momentum study by the end of this 80day cycle and then a turn up in the 12RBS and backtest to enter long, coming out of that low. Will it all go according to plan? We shall see!

12pipRBS

24pipRBS

48pipRBS

Cyclic Phasing: always assuming that my interpretation is correct of course, I have the 80 trading day low coming for the end of the month. The only 10day cycle within that, that did not come in almost to the day, was the 7th, which was early. So, I am looking for an 8th 10day low to conclude this 80day cycle which has spent half going up and the 2nd half going sidewards. The Raff Regression channel from the last 80 day low has its LTL at just below the annual pivot (1.3476) and a touch there would be a neat to say the least. This would mean price 'cutting' the 20 day FLD (orange) to reach down to the VTL (pink dashed) also sat at the annual pivot (white dashed) or the Harmonic line at 1.34375. I don't really mind how far price pushes downhill, as I am net short, but catching the lift up the other side might be very rewarding indeed.

The 5x10 & 10x20 day trends were negative on Friday, notwithstanding the recovery late on, (see 1st sub-chart) with price hovering above the 80day FLD and the 160day sat right underneath. The placement of the 80day FLD is the key anchor point for me, once I am confident the 80day cyclic low is in place. The further away price can be from the FLD, at its cyclic low, the more punch I'll get for my risk long later. A move down through the 80day & 160day FLD this week, should zip through to the 20day & 40 day FLDs with no issues whatsoever (being half way points of smaller cycles) and I think that daily bolly band and 200dsma look just peachy for a realistic eventual target. The question I ask, is where the market would want to be before committing long and that seems to be a great supply zone to me. Will it get there is not up to me!!

Moving into the 30min chart and we can see that price action created an inside day, Friday. The 1-5day trends were all positive at the close, but price was being capped by the weekly FLD, with the daily and 2 weekly FLDs below the daily pivot. There was enough potential in the 4hr momentum studies for me to cover half my shorts at the close, although I hope to lose them for a small gain or BE before any move downhill gets going. Generally, I am looking for a move down to the 20day FLD at the bottom of the chart and that then to get 'cut' to the downside, to mark the half way point in a move down to the 1.3476 area (hope!!).

As matters stood Friday, the Range Bar Studies all remained bullish, albeit they are derivatives of each other of course. What I am looking for is a push down in the 48pip RBS with a nested low in the momentum study by the end of this 80day cycle and then a turn up in the 12RBS and backtest to enter long, coming out of that low. Will it all go according to plan? We shall see!

12pipRBS

24pipRBS

48pipRBS

Friday 21 February 2014

EURUSD

Price just could not hold the underside of the 80day FLD or the LTL of the regression channel up from 1.3476 today, although is sat inside the 5day FLD at the close. With the daily bollys and 80day price envelope in the 1.3818 area and the 4hr momentum cluster looking poised, I have banked all shorts in profit from the bouncing price action today and covered half of the rest. This feels like perfect 'peek, poke & drop' territory with that roof space above and the need to get down to the 20day FLD below as well, and it could be a 5th up to complete the assumed 'e' leg. It has been very profitable playing the range to the downside this week and there is still all of next week to fit in my 80day cyclic low, so plenty of time for a drive down, even if there is a new high, first. I did not want to go into the weekend with naked shorts alone, but I am 50% net short and comfortable with that. Have a great weekend everyone.

EURUSD

Well, a 'b' wave triangle, but in the other direction! If the high can hold out, then perhaps a more aggressive, 1-2, but if not, I am still looking for a move down into the month end. I'll mark it up as a 1-2 for now.

Currency Trading has been difficult......apparantly

This article in Bloomberg caught my eye. I have had my best ever start to the year, as the work over the past 6 years has bedded in. It has been tough with the tight ranges, but my 'Lines in the Sky' methodology continues to provide measurable storyboards and directional cues. May it long continue, although I accept everything has its day in the sun.

EURUSD

I suggested yesterday that consolidation under the 80day FLD might occur, and it seems that we have a triangle ready to feed the next drop down. If this is a 'b' wave then a measured 162% extension from the top, takes price to the Monthly Pivot at 1.3580. Not a bad place to bank the shorts and sit out the weekend and my lecture day on Monday. Catch up later.

EURUSD

Not a lot of upside created in price overnight, although momentum has reset enough for me to be interested again in being short. Price has held under the 80day & 5day FLDs, which brings the 10day, 40day & 160day FLDs into the 'ladder', sequentially. I am looking for the 20day to be hit somewhere on its route and to do that, price will have to get through the rest first, along with the 20/50 & 100day SMAs. A tall order if that lot wants to be support, but a lot of stops in a tight space if that is what the market wants as fuel. For now, the 5/10 & 10/20 day trends are downhill, so I'll keep following them down until they turn up - the momentum study on the 12hr chart (last) suggests there is some room to go, albeit price is fighting that new 80/160day bullish trend, quite fitting given I am looking for an end of month low in the cyclic phasing work.

Thursday 20 February 2014

EURUSD

Frustrating but profitable! Have banked the added shorts from earlier and gone flat again. Same reason as earlier with no progression downhill and 1hr+2hr momentum studies oversold. These may or may not bounce price at this key support but if this is a retracement downhill, they are usually strong enough to be worth backing. If the price pushes on down, well, I'll have to wait until they rest themselves higher, regardless. Will post again when moms are overbought.

EURUSD

Have banked the longs and re-building short positions again. Price sat below yesterday's low and may consolidate here to burn up oversold momentum. I have the 10/20day trend now turning negative and any thrust down, could catch lower, so I am short only and will cover on a new high.

EURUSD

Price has stalled at the 160day FLD (gold line), which is also the regression channel perimeter of the move up from 1.3476 and above the 20,50 & 100day SMAs. Although the longer term momentum studies have only just got going to the downside, I have both the 1hr & 2hr studies oversold with price action stalled at this bus stop. I have taken the opportunity to bank all the shorts taken out above this point and covered the rest, whilst I wait for these two shorter term studies to reset themselves in a retracement or otherwise. Whether I have been too cautious or not is not an issue with Claims out this afternoon. Flat and content for now and hoping for another stab downhill from a higher vantage point or similar, but with any uphill momentum worked through by the market. With price under the daily pivot and the 1/5/10day trend bands all facing downhill, and with longer term momentum studies up to the daily, all teetering in overbought, there is no option for me to buy this. Catch up later.

Wednesday 19 February 2014

EURUSD

With the ongoing saga developing in Ukraine, it is interesting to watch this EURUSD price action coming into a cyclic high, before my 80day Cycle low is due at month end (see yesterday's phasing report). The momentum study here obviously needs to rest at some point, and it is this downward storyboard that I have been interested in since Friday. I have overlaid the 20,50,100 & 200day SMAs, for a sense of purpose, and if price is to reach the FLD trough in the 1.3500 zone, it would need to clear all of these SMAs and the 160day FLD too. The point being, there is stiff support in that 1.3600-1.3650 zone, but clear that and the 200day SMA at 1.3400 must be the initial target. Given that this is below the annual pivot at 1.3471, I'd expect any impulsive move to be a little more dynamic than of late. We shall see, but no room up here for me to think long but that 1.3600-1.3650 area will be key in assessing any progress in either direction.

Tuesday 18 February 2014

EURUSD

Not a lot has changed since Friday, accept for my underlying trend indicators showing negative divergence in the lower time frames and overbought conditions up to a daily chart. As far as my 80day cycle is progressing, I am going to assume that the end of the month is on target and that last week's low was the 7th 10day low come early. As such, this is likely the 8th 10day high and the next drop should be into the 10,20,40 & 80 day lows combined.

I have marked the 20day fld trough with green arrows and I am targeting that zone for my shorts to be banked. To get there, price will have to pass through the 5day, 10day and 160 day FLDs, the latter providing firm support last week. If it does break this time, the 20day should be an easy target but the upward slope of the 160day, suggests more upside in due course to at least retest it. So, long from the 20day trough at the end of the month is my goal, although possibly catching the bottom of a wave 2.

I am running two EW counts, both looking for a move down to fit the Cyclic Phasing. The first calls for this to be the 5th leg of a 'b' wave expanding diagonal, and the second as a 'b' wave in a zig zag. I think the second count fits better with the phasing but that assumes to the 20day FLD holds in the second chart. So, I remain bullish longer term, but bearish until my shorts are banked - now is that biased??

Friday 14 February 2014

EURUSD

Price has made it back to the bottom of the diagonal, where the Monthly & Weekly Pivots R1 sit alongside the 1.3672 square root progression line, but wasting precious time on a Friday afternoon looking at it. If it breaks and makes it to 1.3585 area, I'll bank shorts and come back Tuesday after lectures. I just hope it does not sit here all evening!

EURUSD

It is the waiting that makes this job so tiring sometimes. Regardless, price continues to sip at the 80day FLD, hopefully for some energy! The 20day FLD is beckoning nearer the bottom of the 80day price envelope and I am sure the market would prefer to buy down there than up here. So, notwithstanding the grind higher, I only have eyes for something cheaper. Looking like an expanding diagonal on the 15 min chart, so a breach of that and a turn down in the trend band and I'll be happier.

EURUSD

If my Hurst Cyclic Phasing continues to hold this 80day cycle together, the 80 day low is due at the end of February. That low Wednesday, could have been the 7th 10day low, but it would be very early and I'll work on the basis, it is not. As such, I am looking for that low to come in next week, but the rise out of that, then likely to be a 'b' wave, providing room for the final drop into the 80day low to unfold. These ends of cycles are a little fraught with emotion, not least of all, mine, with the possibility that the cycle is already over and it is my bones being picked clean. I do not think it is over and the next drop should be part of a final move down, and as such, there should be a persistent impulsive move to prove it. For sure, if all goes well, catching the thrust out of that low in early March should be very rewarding indeed.

EURUSD

Little expanding diagonal there on the 3min chart, having broken out of yesterdays consolidation. A break below yesterday's high, would move price in the bearish direction.

EURUSD

Well, the direct route down to the 10day FLD has not been taken, but the drawn out price action yesterday suggests a different larger prize. A decline now to retest the Annual Pivot would push through the 10day, on the way to reach the 20day FLD, now in trough territory below - see orange line and green arrows. Looking for a move down towards the pink trend line that joins the last two 20day FLD troughs near 1.3500. I'll bank there and reassess the momentum study (hope!!) as again, the next 10day low is due 17th/18th next week.

Thursday 13 February 2014

EURUSD

EW Count updated - have tidied up the 'Blue' waves to make the overall pattern more symmetrical. The count still looks for a commitment southbound to get the 'C' wave on the map.

EURUSD - just a little room to breathe

Here is what I am looking at on a 48pip range bar chart. May or may not hold, but giving just enough room to breathe.

EURUSD

Without retracing to the 10day FLD, and with the trend band still in sell mode, I have to assume this is a deep 'b' wave back up here. It has snagged my short cover, but I have just banked that and shifted it above the 1.3682 high from yesterday. This may in fact be another 'c' wave up instead, but that would still mean a decline afterwards, so looking to catch any downdraft to retest that annual pivot. Anything more exciting than probing around the 80day FLD and I'll sit with the longs until the low is in and try and lose the shorts instead next week.

EURUSD

Price has made it back to the weekly FLD (purple) that was cut yesterday, having bounced off the 160 day FLD. The 5/10day trend band is still bearish and I am counting this as a 'B' wave correction for now as the 10day cyclic low is not due until early next week. The momentum study is not overbought yet, but I am starting to short again with cover above the 'b' wave high there at 1.36515. Target is the red 10day FLD or lower.

Subscribe to:

Posts (Atom)