Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Sunday 21 December 2014

The coming emerging market debt meltdown

The coming emerging market debt meltdown by Martin Armstrong

Friday 19 December 2014

#dax $dax

In the land of the shallow pull backs, I think the Dax reigns pretty high. The reaction to the 123.6% extension and the 76.4% retracement of the ATH to recent low, has been anaemic thus far. More importantly, the 15min stochs (right) are clearly putting in a retracement after yesterday's wave up, but giving the impression that back up is probably more likely than continuing down. Yesterday's high was 9854 and for now that looks like the centre of attention. Back through today's open at 9910 and the 162% extension at 10011 is possibly on.

In the land of the shallow pull backs, I think the Dax reigns pretty high. The reaction to the 123.6% extension and the 76.4% retracement of the ATH to recent low, has been anaemic thus far. More importantly, the 15min stochs (right) are clearly putting in a retracement after yesterday's wave up, but giving the impression that back up is probably more likely than continuing down. Yesterday's high was 9854 and for now that looks like the centre of attention. Back through today's open at 9910 and the 162% extension at 10011 is possibly on.

Thursday 18 December 2014

#dax $dax

Price has pushed on from the 61.8% retracement line and now approaching the 76.4%. This is also the 123.6% extension of the internal 'a-b' of this move up. Still looking for that hourly stoch to unwind to either give us an 'abc' back or another leg lower as per the 4hr chart (right). Something to hang ones coat on would be a start!

Price has pushed on from the 61.8% retracement line and now approaching the 76.4%. This is also the 123.6% extension of the internal 'a-b' of this move up. Still looking for that hourly stoch to unwind to either give us an 'abc' back or another leg lower as per the 4hr chart (right). Something to hang ones coat on would be a start!

#dax $dax

Nice surprise this morning. Have dropped my cover and added to shorts at the 61.8% approach. Even a 3 wave pull back here would be worth a try, even if trend has moved back uphill. The hourly stochs have a whole cycle to unravel at some point and from somewhere around here would make sense. Would obviously prefer a new low!

Wednesday 17 December 2014

#dax $dax

Been a bit of a mooch since yesterday's rise. As I discussed then, I was working on the basis that we would get a 'b' wave pull back, and I wonder if we have already seen the 'a' leg of the 'c' leg in the form of a leading diagonal. All a bit messy but price is holding above the open at 9440 for now, and perhaps looking for shorts up in the 9650-9750 zone is the strategy to play. If the retracement of yesterday's rise to gets some wind, then buying lower would also be on the cards.

Tuesday 16 December 2014

#dax $dax

After a 2nd retest of that 9222 retracement line, we seem to be in a pullback from the low. The 38.2% has already been hit this afternoon, but I am counting this slide this evening as the 'b' wave, anticipating a 50-61.8% top tomorrow in the 9655-9750 range to short again.

#dax $dax

Direct hit on the 50% retracement from 8351 to the high, but nothing broken for this downward trajectory as yet. Looking at the regression channels of this move from the high and the 'b' wave, there is a neat looking contracting diagonal rolling down to the 61.8% there. I just wonder, if a possible set up for a Santa Claus rally, might see something a little more climactic, spiking down to the 76.4% first? For now, that last zip down needs digesting.

Monday 15 December 2014

#dax $dax

Been in meetings today, but this morning's post kept on the right side of price action. Shorts banked. That MyWave band is built around the 3 day adaptive MA - a 38.2%-50% pull back from the high gets back to 9602-9696. Whilst inside this regression channel, looking for shorts in that zone.

#dax $dax

The 38.2% retracement from 8351 to the high, sits below at 9427. If price is going to bounce back up again to kiss the regression channel of the move up from the underside or just this downward facing one (see 4hr chart right), then a stretch down to there first would make for a great round trip. At the moment price is mooching around the daily open, so decision time.

The 38.2% retracement from 8351 to the high, sits below at 9427. If price is going to bounce back up again to kiss the regression channel of the move up from the underside or just this downward facing one (see 4hr chart right), then a stretch down to there first would make for a great round trip. At the moment price is mooching around the daily open, so decision time.

Friday 12 December 2014

#dax $dax

Price has made it to the 100% extension discussed first thing this morning. Not a lot of strength in this market at the moment but would expect a bounce from here to test the 50% speedlines and weekly tramline above. Or else straight down to the 123.6% extension sits at 9527.

#dax $dax

The rise yesterday did not take out the previous high, so I am working with that being the 'b' wave in 'C' down. Low 9600s looks about the right place to bank shorts for me.

Thursday 11 December 2014

#dax $dax

Price could not hold below today's open so assuming that this is still 'b' of 'c' or still 'b' retracing the move down to 'a' - shown as an expanded flat here, but await final price action to clarify. Looking to short a turn down.

#dax $dax

I have added in a directional overlay (the arrows in the circle) to keep the counts organised in a slightly more objective way. They are currently holding on the hourly chart in the downward stance and as such, I am counting price as in the 'b' of 'c' downhill. If price can make it below today's open of 9772, I am looking for 9600 at the 100% extension.

Wednesday 10 December 2014

#dax $dax

New low and test of yesterday's as discussed earlier, in place. Now got positive divergence on the RSi, which was missing yesterday but no upward ratchet as yet. Waiting for an elegant entry for possible confirmation of flat completed or a bounce before more lows. I am sure I am not the only one eyeing up that 10240 level, but maybe that is not going to happen this time around. All, I can do is follow the intraday trend and for now that is sat looking at this low and musing on the matter.

#dax $dax

I am going to be out of the office till this evening now and the market are still deciding what to do, me thinks - isn't it always!

The 4hr chart shows the monthly trend turning down and price below the 2month trend line now. I would still expect to see a push up into these, and the 4hr stochs are looking oversold.

The 60minute chart shows the 1-3 week trends with price is doing little with the upturned stochs for now. As suggested yesterday and this morning, a retest of that low at the 123.6 extension or a thrust lower to 162% is not out of the question.

The daily trend is currently bullish, but price is still under the daily open and the daily 50% retracement line, giving me no conviction to buy at the moment. I am looking for the 5 min stochs to go oversold with price above the daily trend band, and either above the daily open or close enough to make a concerted effort to rise. More hand sitting.

The 4hr chart shows the monthly trend turning down and price below the 2month trend line now. I would still expect to see a push up into these, and the 4hr stochs are looking oversold.

The 60minute chart shows the 1-3 week trends with price is doing little with the upturned stochs for now. As suggested yesterday and this morning, a retest of that low at the 123.6 extension or a thrust lower to 162% is not out of the question.

The daily trend is currently bullish, but price is still under the daily open and the daily 50% retracement line, giving me no conviction to buy at the moment. I am looking for the 5 min stochs to go oversold with price above the daily trend band, and either above the daily open or close enough to make a concerted effort to rise. More hand sitting.

#dax $dax

Nice bounce out of that 123.6% extension overnight but I am keeping my powder dry for now. Those red dashed lines coming down the chart are the 50% speedlines from the top, through the sequential lows marked out with the pink boxes. As such, price continues to observe the bearish balance of this move down, so for now, I'll sit tight and wait for a reaction lower to this turn up. Those MAs above are 1-3 week Hulls, which albeit flat, are providing interim cover to the monthly's shown yesterday.

Tuesday 9 December 2014

#dax $dax

Been out for the afternoon and the 'flat' seems to have been a decent call; not that I am anything to do with the outcome of course. However, I am not seeing any positive divergence in that Rsi on the hourly, so will look again tomorrow morning to see if the low holds or whether price is going to push for the 162% at 9681.

Been out for the afternoon and the 'flat' seems to have been a decent call; not that I am anything to do with the outcome of course. However, I am not seeing any positive divergence in that Rsi on the hourly, so will look again tomorrow morning to see if the low holds or whether price is going to push for the 162% at 9681.

#dax $dax

Price is flaming the opening price this morning, but as of yet, that hourly stochastic has not broken it to the upside. Just in case this is a flat, the 100-123% extension sits just below the prior low of course. For now, the weekly trend lines are all stacked down hill, but flat in reality. Compare this to the 4hr chart which shows 1-3 month trends and they are all pushing up. Game plan remains the same: catch this next low for a push to 10240+.

Price is flaming the opening price this morning, but as of yet, that hourly stochastic has not broken it to the upside. Just in case this is a flat, the 100-123% extension sits just below the prior low of course. For now, the weekly trend lines are all stacked down hill, but flat in reality. Compare this to the 4hr chart which shows 1-3 month trends and they are all pushing up. Game plan remains the same: catch this next low for a push to 10240+.#dax $dax

Deep pull back on Dax to 76.4% retracement of last move up. Extensions higher still reach that 10240+zone. Still looking for the turn back up.

Monday 8 December 2014

#dax $dax

Price getting closer to the retracement zone discussed earlier. Looking to long out of this when reversal kicks in. The current 50% line for today (not shown) is 10049, so above there and when the 5 min stochs are oversold, should be a reasonably elegant entry or top up.

#dax $dax

Opening price not recovered so far; 50-61.8% retracement of move from 9832 next place to look for longs.

#dax $dax

Looking at the 4hr chart, the 100% extension of green 'A-B' sits above at 10242. If that RSi study pops the negative divergence into this diagonal perimeter, I suspect that a pull back may be limited to side wards action to provide room for more upside momentum. With the 123.6% extension sitting very neatly at 10500, it could just be, price just keeps moseying uphill, as it has done most of this move. Certainly, the stochs look like they have completed that downside cycle for now and if they hold, looking for shorts may yet again be premature. On second thoughts, I'll just play the longs as mentioned in the last post and forget shorts altogether for now.

#dax $dax

Following on from Friday then, price has reacted to the proximity of that diagonal upper line, but there is room for a grind up the inside today. If price can get above today's open of 10079, then looking for longs into 10125-10150 and then shorts into a pull back.

Sunday 7 December 2014

Friday 5 December 2014

#dax $dax

Expanding diagonal on 45min chart with price approaching top perimeter....recall prior post of contracting diagonal pushing into this top. I might look for shorts again. A pop and drop might be neat.

#dax $dax

In the world of diagonals, break ups and breakdowns are my trade preference. Is this a leading pattern or a 'b' wave - time will tell, but I am banking longs and waiting until I know!

#dax $dax

I will not be able to post until this afternoon due to meetings, but overnight price action has been flat. Going into the Asian session saw price pulling back from the reaction high with the daily price band still red. A retest of yesterday's low or even a marginal new low (which is also the rolling weekly low price too) would provide an opportunity for lower risk longs.

Thursday 4 December 2014

#dax $dax

Well that worked! If it keeps going, looking for 10240 as 100% extension of 'A-B' on the 4hr charts - see previous posts.

#dax $dax

Well, there is the 9850 zone I been after all week: what a route to get there, mind! Looking for break up.

#dax $dax

Not a lot of reaction to that near touch this morning. Plenty of room above the 10048 high if the announcements keep the trend in motion. Looking to position long if breaks above or drops down in a deeper correction.

#dax $dax

Very close to all time high again...could be worth trying a short with only 25 pips at risk, but everything continues to look bullish.

#dax $dax

Still musing on this sidewards grind. Is it a triangle, is it a shallow flat, was 'a' all of the correction and we are already in a slow burn higher? For now, the stochs look overbought on this 45min chart but they only count if it is still in the correction. For sure, it will all be clear after the event!

Wednesday 3 December 2014

#dax $dax

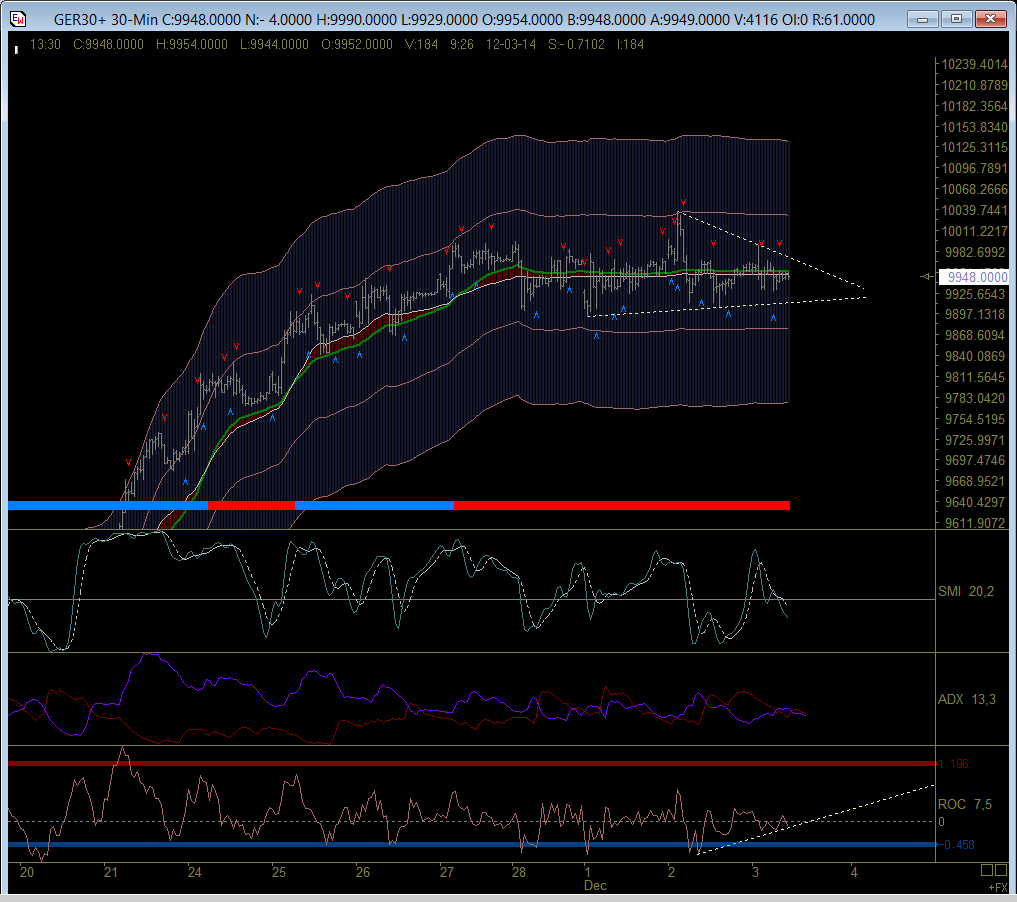

Still no depth to any pull back. Whilst the lack of follow through is making me nervous, the 30min chart seems to be building a couple of exit routes from this ambiguity. I think you have got to back upside break outs, but I'd prefer to buy break downs!

#dax $dax

The correction continues. The 30 min chart (left) is as flat as a pancake, but still hoping for that 9850 level to look to buy, whilst price holds underneath the 76.4% extension of 'A-B' on the 2hr chart. That is still bullish, albeit I need to mindful of that rejection of the all time high yesterday.

The correction continues. The 30 min chart (left) is as flat as a pancake, but still hoping for that 9850 level to look to buy, whilst price holds underneath the 76.4% extension of 'A-B' on the 2hr chart. That is still bullish, albeit I need to mindful of that rejection of the all time high yesterday.

Tuesday 2 December 2014

#dax $dax

Well, this morning's spike looks like it fooled me into changing my count from yesterday's 'b' wave up. Looking more and more like an expanded flat, with target for this 'c' leg into the 8850's. Fingers crossed, it sticks this time. Longs from down there as per yesterday's plan, before being 'v'd!!

#dax $dax

Yet again, waiting for that new low was a waste of time. Corrective sequence yesterday has broken to the upside and the 100% extension of grey A-B is at 10245 ish on my charts. Looking for long positions into there for now, unless this 162% extension of orange 'a-b' can hold the push.

Monday 1 December 2014

#dax $dax

A mind numbing day, but looks like a triangle in a 'b' wave within this correction down. Should be breaking down at some point and assume to downside.

#dax $dax

Having closed this morning's opening gap and tested Friday's closing price, the market is sat above today's open of 9927 and mooching about waiting for the US Open. The 2hr chart shows the linear regression channel from 8351 getting a gentle push on the lower boundary and maybe providing the buying support into this proposed correction. However, the RoC 'flipper' is still engaged and the stochs have trickled under their support, so whilst the corrective channel on the 30min chart holds, my hoped for 9838 zone or lower to buy, still looks possible. Catch up later when something happens.

Having closed this morning's opening gap and tested Friday's closing price, the market is sat above today's open of 9927 and mooching about waiting for the US Open. The 2hr chart shows the linear regression channel from 8351 getting a gentle push on the lower boundary and maybe providing the buying support into this proposed correction. However, the RoC 'flipper' is still engaged and the stochs have trickled under their support, so whilst the corrective channel on the 30min chart holds, my hoped for 9838 zone or lower to buy, still looks possible. Catch up later when something happens.

#dax $dax

Subscribe to:

Posts (Atom)