Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Tuesday, 18 February 2014

EURUSD

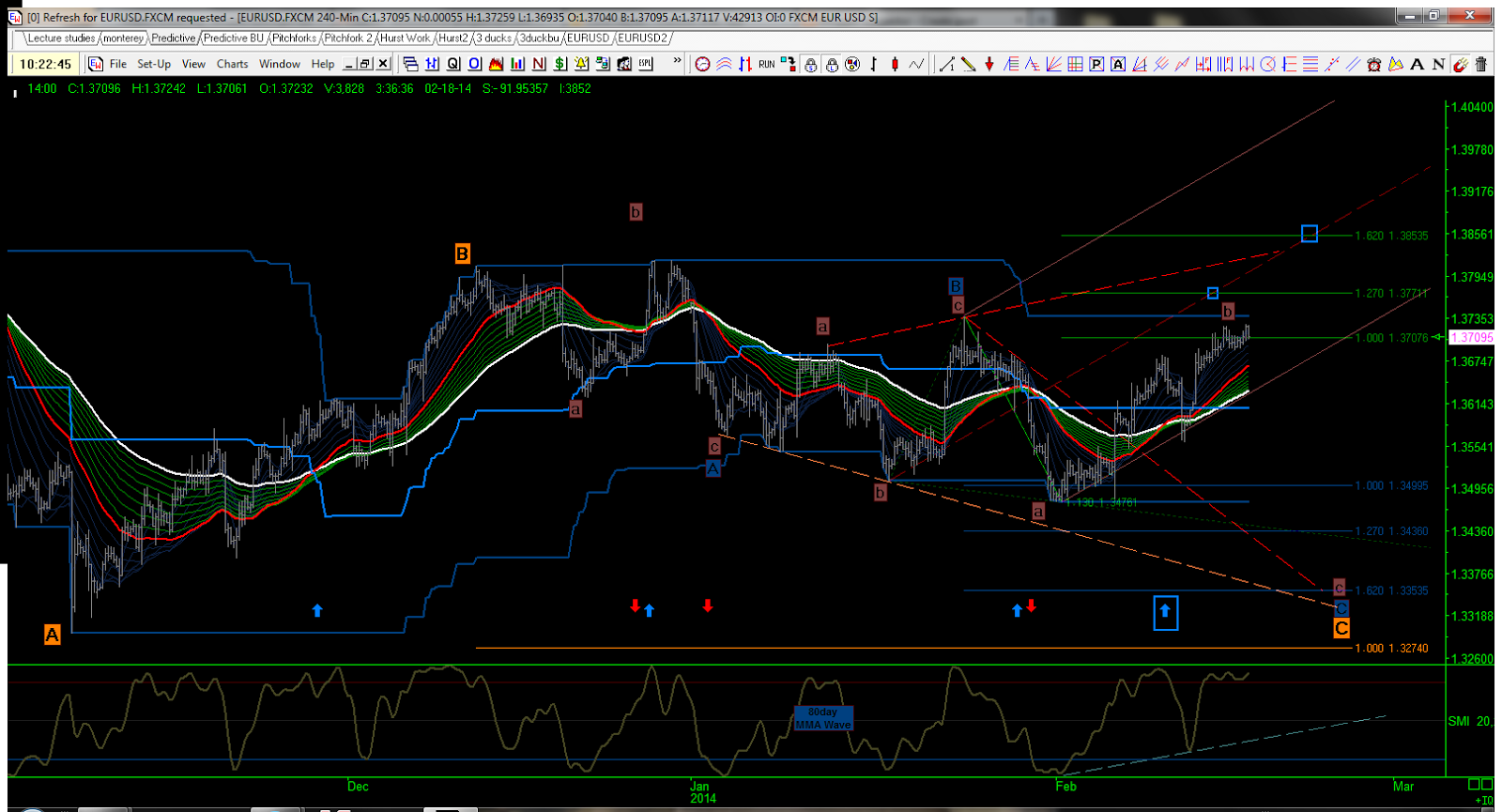

Not a lot has changed since Friday, accept for my underlying trend indicators showing negative divergence in the lower time frames and overbought conditions up to a daily chart. As far as my 80day cycle is progressing, I am going to assume that the end of the month is on target and that last week's low was the 7th 10day low come early. As such, this is likely the 8th 10day high and the next drop should be into the 10,20,40 & 80 day lows combined.

I have marked the 20day fld trough with green arrows and I am targeting that zone for my shorts to be banked. To get there, price will have to pass through the 5day, 10day and 160 day FLDs, the latter providing firm support last week. If it does break this time, the 20day should be an easy target but the upward slope of the 160day, suggests more upside in due course to at least retest it. So, long from the 20day trough at the end of the month is my goal, although possibly catching the bottom of a wave 2.

I am running two EW counts, both looking for a move down to fit the Cyclic Phasing. The first calls for this to be the 5th leg of a 'b' wave expanding diagonal, and the second as a 'b' wave in a zig zag. I think the second count fits better with the phasing but that assumes to the 20day FLD holds in the second chart. So, I remain bullish longer term, but bearish until my shorts are banked - now is that biased??

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment