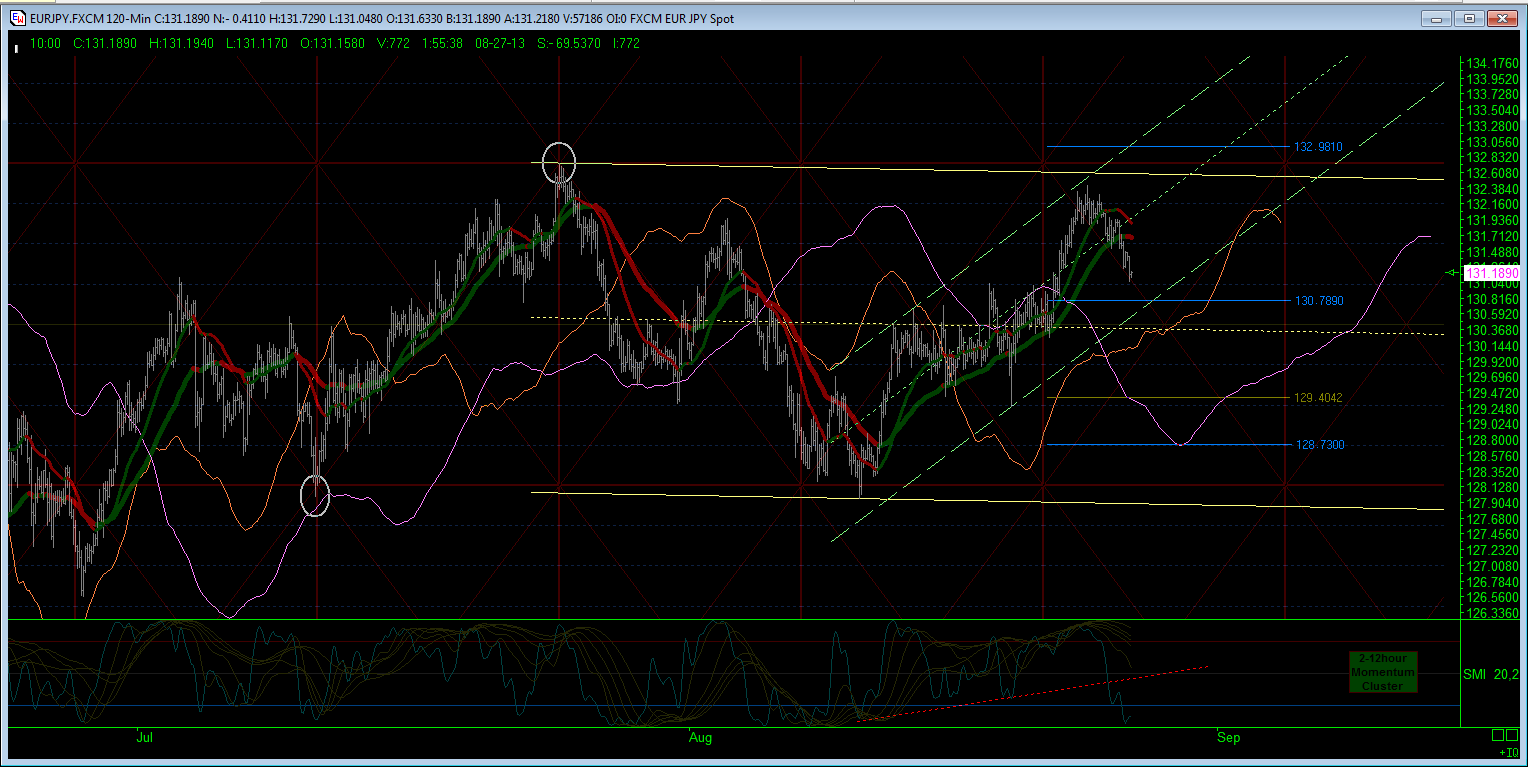

Have been closing out shorts in profit, taken out on the way up and now moved to net long by 40%. In the weekend summary, I suggested the 45degree angle would be a supportive runway for price action and so it has. Over the next day, the monthly price high to the left of the big channel (25 days) is going to drop out of the regression calcs and the channel will snap uphill. So, either we have a new trend downhill as per the trend lines which are now both red, or this PA is corrective as per the 'triangle' thesis. I am hoping for a 'b' wave up before a 'c' wave down to finish the 'e' leg of the triangle, but do not want to be caught out by anything else north bound. But I do not want to over commit up hill yet either, in case the 'c' wave of 'e' takes up all the the triangle. So, nudging long and hope to bank that later as a 'b' and then top up shorts again for 'c' down. We'll see.

Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

No comments:

Post a Comment