Interesting place to roll into the weekend!

240min

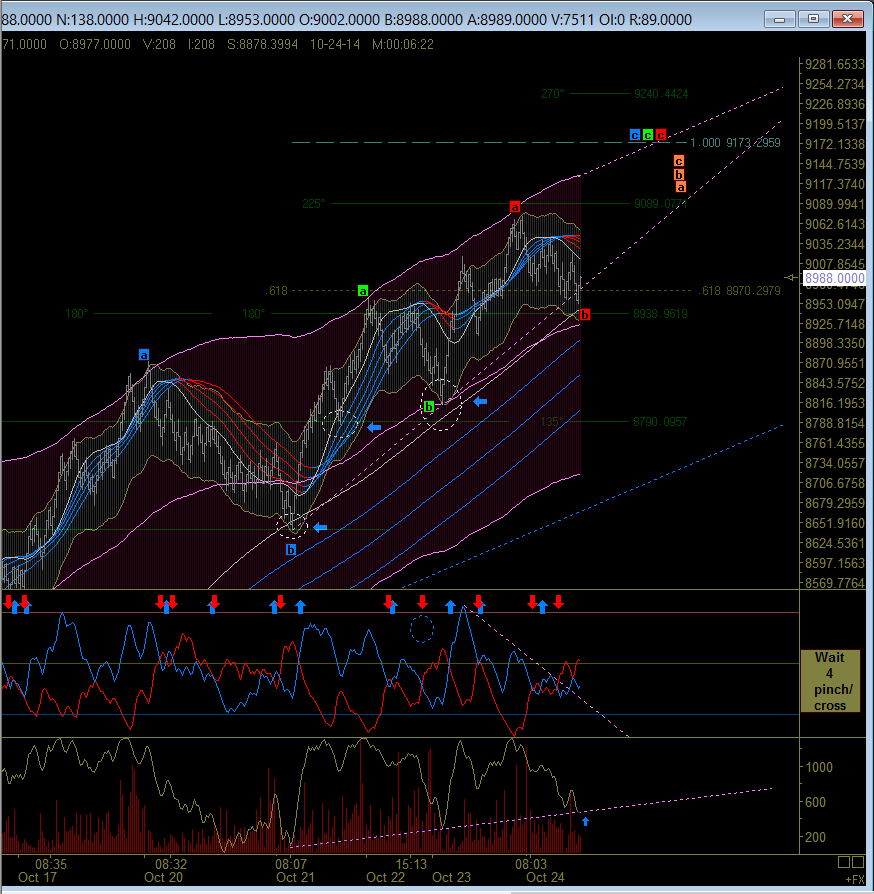

45min

3min

Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Friday, 31 October 2014

#dax $dax

Marginal new high there - looking to short again. Breach of the steeper channel might usher in a change of tempo.

#dax $dax

#dax $dax

I have moved down to a 45min chart to find some harmony on the wave formation: the red MA is 'adaptive' and clearly shows ongoing uphill progression for now. If 9300 is not going to hold, then 9400, may just be the ticket. Would fit a grind into the regression channels from 8351 and the latest low. I want to be short, but nothing to play with so far.

#dax $dax

Looking corrective after this morning's drop off the top. 100% extension is at 9162, setting up next leg higher? Nudging short.

$dax $dax

If the blue 'a-b' is correct, then the 100% extension is 9549. Given the 162% extension of this current leg is only 9422 and at the top of the regression channel from 8351, I am having to assume, this is only 'a' of blue 'C' up. Just puts a different complexion on the shorts in due course. Nudged long for the moment to see how close we get to that 9400 zone.

#dax $dax

That was the 61.8% - price now at upper perimeter of regression channel from 8351, we are in the 7th clear swing up, ADX & stochs are overbought and price is pushing the 1000 bar high/low channel top. Looking to see what the short side does in response.

#dax $dax

Overnight futures suggest the 61.8% at 9302 is a likely candidate; this is also the 123.6% extension of the possible 'abc' move from the 8834 low on the 27th, to complete a triple correction. Still looking for shorting price action as discussed last night.

Thursday, 30 October 2014

#dax $dax

Been at the Dr Who convention in Cardiff with my boys today, so a little late in writing up. Third time up at the 50% retracement, and for me, time is running out for this move. The brown line coming down from above in this study is the rolling 1000 high of the 24 pip range bar. The lighter brown line below that is falling is the median of the high-low range for the same 1000 bars. Price is at the median line of the regression channel up from 8351 and looking punch drunk on both the ADX & cycle indicator. I am looking for shorts.

Wednesday, 29 October 2014

Tuesday, 28 October 2014

#dax $dax

16 pip cycle

Price is peppering the 76.4% retracement of yesterday's high to low. Stochs are overbought and ADX high. If it is going to turn down, around here is probably the last stand. Currently, MyWave is bearish at this degree.

8 pip cycle

The 8 pip cycle has turned bullish but MyWave is down at 8920. Given the stochs are oversold at this degree, I think more grinding into that 76.4% yesterday's high, either to let this degree catch up with price and/or to roll over the 16 pip cycle to bullish. No place or time to be long for me with that gap between price and MyWave.

4 pip cycle

This degree is also bullish and given the proximity of MyWave, it is leading the 8 pip cycle for now and putting the pressure on the 16 pip cycle. Who is zooming who? The closer to yesterday's high, the safer the short form me, whilst the 16 pip MyWave is down and the stochs overbought.

Price is peppering the 76.4% retracement of yesterday's high to low. Stochs are overbought and ADX high. If it is going to turn down, around here is probably the last stand. Currently, MyWave is bearish at this degree.

8 pip cycle

The 8 pip cycle has turned bullish but MyWave is down at 8920. Given the stochs are oversold at this degree, I think more grinding into that 76.4% yesterday's high, either to let this degree catch up with price and/or to roll over the 16 pip cycle to bullish. No place or time to be long for me with that gap between price and MyWave.

4 pip cycle

This degree is also bullish and given the proximity of MyWave, it is leading the 8 pip cycle for now and putting the pressure on the 16 pip cycle. Who is zooming who? The closer to yesterday's high, the safer the short form me, whilst the 16 pip MyWave is down and the stochs overbought.

#dax $dax

Given the insipid reaction to the drop yesterday, probably safe to assume that we are in 'b' of the retracement off yesterday's high and in the 'b' leg of that. The 3hr chart looks like a good bed/ ichimoku cloud for price to nestle into, with 'c' leg targets of 8722-8634 (50-61.8%). Overnight price action seems to have nudged higher again past 8938, but looking for strength to sell as long as yesterday's high holds.

Monday, 27 October 2014

#dax $dax

Oh my: that really is slow! Not a lot to add to earlier. Thought I'd throw in the 60min Ichi Cloud with a couple of displaced MAs - above 8938 for me and just perhaps, I'll get my count. Either here or lower, I am looking for this to rise. Did I just write that?!

#dax $dax

Price got stuck and market needs to make a decision. There appears to be lower time frame H&S for up and bigger ones for down. Who is zooming who?? 8938 is still the key line and sits just above in the regression channel from 8351. I have locked the channel top into this morning's high and as can be seen, up or down should seal the argument. But for now, I am still leaning long but cover just under the channel lines there.

#dax $dax

Nice bounce! At least the market is giving my count a look in from earlier. 8938 again sits above - if price can push on through, then I'll be looking for the 61.8% target at 9300, but that is 'if' ! At the moment, the trend band and ADX are forming resistance. We shall see...

#dax $dax

I am giving this a little room to breathe but not much. Trying to be long with positive divergence on the ADX & the trend band still tact. Would be a great rubber band shot, if it zips up the screen. But it has taken out the support line, so not certain on this at all. We shall see.....

(amended chart 13.55pm: count change)

#dax $dax

Well that was 8938 give or take, but is this an irregular flat? Nothing broken on the MA band or MACD - nudging long and will move to B/E asap. Careful of upside thrust instead of diagonal breakdown. Now at 61.8% retrace of green 'b' to red 'a'

#dax $dax

So that is the new high I was looking for from the weekend's analysis and therefore I am now looking to get short. I am showing a 60min & 4hr chart with the same Pyrapoint lines at 45degree steps from 8351 as used last week. Given I am looking for shorts, I have added the diagonal support lines on the 60min to highlight any obvious rejections and breaks to the downside. It appears that a return to 8938 would provide a starter for ten on the short side and provide a red diagonal break. I am expecting negative divergence on the MACD on the hourly, so whether a break of 9089 would pop to 9240 first is not high on my possibility list, but holding that 9089 line now or later is key to getting down to 8938. The 50% retracement line at 9121 looks like a decent high to watch for. I think the battle lines are drawn; let the daily games begin.

So that is the new high I was looking for from the weekend's analysis and therefore I am now looking to get short. I am showing a 60min & 4hr chart with the same Pyrapoint lines at 45degree steps from 8351 as used last week. Given I am looking for shorts, I have added the diagonal support lines on the 60min to highlight any obvious rejections and breaks to the downside. It appears that a return to 8938 would provide a starter for ten on the short side and provide a red diagonal break. I am expecting negative divergence on the MACD on the hourly, so whether a break of 9089 would pop to 9240 first is not high on my possibility list, but holding that 9089 line now or later is key to getting down to 8938. The 50% retracement line at 9121 looks like a decent high to watch for. I think the battle lines are drawn; let the daily games begin.

Sunday, 26 October 2014

#dax $dax Weekend Review

Weekly Charts

A three dimensional approach this weekend on the weekly's. The first is an Ichimoku chart, which lays out the main technical discussion points. Firstly, that the EW count of a Wave 4 is either in progress or completed, from the base at September 2011. The move down from the top has taken the form of an 'abc' retracement in a different formation to that of Wave 2, with the 'c' leg reaching past the 123.6% extension of the 'a' leg. As such, this could be counted as Wave 4 completed or 'A' of Wave 4 completed, with this move uphill being 'B'. Price is thus far holding below the neckline (red dotted line), sitting inside the cloud having made a stab out of the bottom. The volume spike on the drop through the neckline and cloud was quite significant, I assume as stops were hit and new longs bought the low. Indeed, the stab down coincided with the Chikou Span pushing through it's own neckline and price action from 26 weeks ago. Price is also below Tenkan Sen and Kijun Sen, which although showing consolidation flatness at the moment, and are themselves crossed to the downside. These are also sat at the H&S neckline, providing heady resistance above. As matters stand, price is holding the bearish argument in my opinion, with that neckline the key zone. I am at least looking for a 'b' wave downhill, in this retracement up or the commencement of the 'a' leg of 'C' downhill, if this leg up from 8351 is coming to an end.

The second weekly chart shows the same 90 degree Pyrapoint steps up from the September 2011 low as shown in the first chart. Note that price has broken and is thus far holding the 9109 line as overhead resistance, which coincides with the neckline and the Tenkan Sen/Kijun Sen cross in the first chart. The trend band, MACD & ADX are all holding bearish here, but that red ADX line is way oversold, by holding the top line like that. What I would want to see is a 'kiss' between the blue and red lines to show the possibility of a completed retracement. However, the 8179 support line below is the 360 degree pyrapoint line from the September 2011 low, a significant degree to be left behind me thinks. There are no bullish formations to work with bar the volume spike in these charts, so I am going to assume that the oversold conditions on the ADX will be worked off with price action between these two lines: 9109 & 8179.

The third Solar Cycle study shows price holding below the pink dashed trend line, dipping in sympathy with the mid-point of the 11 year average Solar Cycle. However, it is still well within the confines of the blue regression channel set from the assumed 2009 end of the last cycle. Although the stochastic seems to suggest there is more work to do to the downside, my general impression thus far is that the green 'long' cycle mid point of May 2016 is going to be the crash zone, not this one. This would seem to suggest some renewed intervention in the markets coming, or not, as the case may be. But whilst that regression channel holds, I am still considering this a Wave 4 and not something bigger.

Daily Charts

The daily Ichimoku chart tells the same story as the weekly. Chikou Span is in the open and the Tenkan Sen/Kijun Sen cross is down. However, the stochs got oversold, the volume spike came in and it appears that whilst price is under the cloud, we are in a retracement. Given that neckline and the pyrapoint 9109 line, however, it would not surprise me to see a 'b' wave triangle or flat building underneath until the cloud is reached or maybe a diagonal formation into the 8179 support line, if 'b' is coming to an end. Either way, as long as the neckline holds (regardless of any temporary forays above), there is nothing to suggest a bullish stance for me here.

The second chart mirrors the 2nd weekly one. The ADX lines are working in for that kiss having been oversold, and the trend band has gone flat whilst waiting. Again, whilst that neckline holds, and all my other studies hold bearish, I am looking for downside price action to unfold, either in an ongoing correction or new declines. Given the oversold weekly ADX as discussed earlier, I am leaning more towards a larger corrective structure.

4hr charts

The 4hr Ichimoku shows price has pushed itself into a bullish formation, with Chikou Span and the Tenkan Sen/Kijun Sen cross, looking positive. But the position of the stochastic in line with the internal count of the move up, suggest a correction back down hill is coming, probably after a push up through the neckline.

The 2nd chart shows a bullish MACD & ADX, the latter having crossed up in this bullish move. I would expect that cross to be tested and this will coincide with the pull back. The trend band is holding bullish for now with the 50% retracement (down from 9892) at 9120 looking like a very viable target in the short term to push a little beyond the neckline and complete the internal count.

60min

The push up into the close Friday, combined with this weekend analysis, suggest to me that price should push up now into a final move for this wave from 8351. You can change the blue 'C' wave counts to 1-5, if that suits readers better, but this works for me. What transpires after that pop up will clarify the bigger picture, but I'll be looking for short positions on any new high and see where that takes me. Anything different to this layout will have me re-looking at the whole picture.

A three dimensional approach this weekend on the weekly's. The first is an Ichimoku chart, which lays out the main technical discussion points. Firstly, that the EW count of a Wave 4 is either in progress or completed, from the base at September 2011. The move down from the top has taken the form of an 'abc' retracement in a different formation to that of Wave 2, with the 'c' leg reaching past the 123.6% extension of the 'a' leg. As such, this could be counted as Wave 4 completed or 'A' of Wave 4 completed, with this move uphill being 'B'. Price is thus far holding below the neckline (red dotted line), sitting inside the cloud having made a stab out of the bottom. The volume spike on the drop through the neckline and cloud was quite significant, I assume as stops were hit and new longs bought the low. Indeed, the stab down coincided with the Chikou Span pushing through it's own neckline and price action from 26 weeks ago. Price is also below Tenkan Sen and Kijun Sen, which although showing consolidation flatness at the moment, and are themselves crossed to the downside. These are also sat at the H&S neckline, providing heady resistance above. As matters stand, price is holding the bearish argument in my opinion, with that neckline the key zone. I am at least looking for a 'b' wave downhill, in this retracement up or the commencement of the 'a' leg of 'C' downhill, if this leg up from 8351 is coming to an end.

The second weekly chart shows the same 90 degree Pyrapoint steps up from the September 2011 low as shown in the first chart. Note that price has broken and is thus far holding the 9109 line as overhead resistance, which coincides with the neckline and the Tenkan Sen/Kijun Sen cross in the first chart. The trend band, MACD & ADX are all holding bearish here, but that red ADX line is way oversold, by holding the top line like that. What I would want to see is a 'kiss' between the blue and red lines to show the possibility of a completed retracement. However, the 8179 support line below is the 360 degree pyrapoint line from the September 2011 low, a significant degree to be left behind me thinks. There are no bullish formations to work with bar the volume spike in these charts, so I am going to assume that the oversold conditions on the ADX will be worked off with price action between these two lines: 9109 & 8179.

The third Solar Cycle study shows price holding below the pink dashed trend line, dipping in sympathy with the mid-point of the 11 year average Solar Cycle. However, it is still well within the confines of the blue regression channel set from the assumed 2009 end of the last cycle. Although the stochastic seems to suggest there is more work to do to the downside, my general impression thus far is that the green 'long' cycle mid point of May 2016 is going to be the crash zone, not this one. This would seem to suggest some renewed intervention in the markets coming, or not, as the case may be. But whilst that regression channel holds, I am still considering this a Wave 4 and not something bigger.

Daily Charts

The daily Ichimoku chart tells the same story as the weekly. Chikou Span is in the open and the Tenkan Sen/Kijun Sen cross is down. However, the stochs got oversold, the volume spike came in and it appears that whilst price is under the cloud, we are in a retracement. Given that neckline and the pyrapoint 9109 line, however, it would not surprise me to see a 'b' wave triangle or flat building underneath until the cloud is reached or maybe a diagonal formation into the 8179 support line, if 'b' is coming to an end. Either way, as long as the neckline holds (regardless of any temporary forays above), there is nothing to suggest a bullish stance for me here.

The second chart mirrors the 2nd weekly one. The ADX lines are working in for that kiss having been oversold, and the trend band has gone flat whilst waiting. Again, whilst that neckline holds, and all my other studies hold bearish, I am looking for downside price action to unfold, either in an ongoing correction or new declines. Given the oversold weekly ADX as discussed earlier, I am leaning more towards a larger corrective structure.

4hr charts

The 4hr Ichimoku shows price has pushed itself into a bullish formation, with Chikou Span and the Tenkan Sen/Kijun Sen cross, looking positive. But the position of the stochastic in line with the internal count of the move up, suggest a correction back down hill is coming, probably after a push up through the neckline.

The 2nd chart shows a bullish MACD & ADX, the latter having crossed up in this bullish move. I would expect that cross to be tested and this will coincide with the pull back. The trend band is holding bullish for now with the 50% retracement (down from 9892) at 9120 looking like a very viable target in the short term to push a little beyond the neckline and complete the internal count.

60min

The push up into the close Friday, combined with this weekend analysis, suggest to me that price should push up now into a final move for this wave from 8351. You can change the blue 'C' wave counts to 1-5, if that suits readers better, but this works for me. What transpires after that pop up will clarify the bigger picture, but I'll be looking for short positions on any new high and see where that takes me. Anything different to this layout will have me re-looking at the whole picture.

Friday, 24 October 2014

#dax $dax

Well, that did bounce but coming into Friday at 5pm, and I am out - frustrating day with a number of 30/40 pip trades but seemed to work very hard for the pay cheque! Closed out all trades to start afresh Monday morning. Will do an update over weekend but leave you with the two counts I was trying to prise apart today. Thank you for reading.

#dax $dax

Hourly chart with diagonal laid out. Next leg up would be the 5th in the diagonal - any new high would be enough for me!

#dax $dax

Gone flat into that last poke lower: the red 'a-b' count could be holding here. I reckon there is another poke lower to come as previously discussed, but it is very bouncy, and would rather pick up longs rather than concentrate on losing shorts. Next leg up to 9150 would be perfect but do not think my nerves will hold out past 9100, if it happens that way.

#dax $dax

Price action looking heavy at the trend line for the diagonal - maybe the count is even more bearish and the red 'a' is in fact green 'c' for blue 'c' already. I'll not be trying to catch any proverbial knives if its starts rushing but may bank some shorts on way down, cover above daily open at 9027. Catch up later.

#dax $dax

Looks like my thoughts were correct this morning. Getting into that 8938 zone but want to be careful that further ferreting lower does not happen nearer 8909 for stop hunting. Time to look for longs nearer there than here me thinks but could miss out if does not tug down.

#dax $dax

If this mooching about is a 'b' wave following the drop off last night's high, it is looking bigger overall than the prior move back into 8909. I am showing an alternative count here where although the test zone is likely to be near the 8938 support area, I am not going to be jumping in long until I know that the 8909 low has been backtested properly. The 162% extension of the proposed 'a-b' from last night is at 8900, 9 pips lower than that 8909 low. Given there would be plenty of stops under there, just need to be wary of a draw lower to clear out timid longs in that zone. This all supposes, price does not just keep going up into the 9150 zone, but I am not interested in going long until lower again.

#dax $dax

8938 was the last support zone below - orange 'b' may be aiming for that, providing excellent opportunity to find longs with the prior low as cover at 8909. A clean hit of 8938 is to be looked out for with volume spikes into that zone. Either aiming to be long down there or short higher up but not fiddling around in the middle of the 8938 to 9089 S&R lines.

#dax $dax

Lots of 30-40 pip moves - consolidation usually precedes a bigger move and I'd rather see which direction that is going to be first. Banked longs from this morning's low and gone flat at 9030.

#dax $dax

Banked the shorts from last night and now hoping for that rise into the 9150 zone. This is the count I am focusing on with a diagonal formation coming to a conclusion. As I have said repeatedly this week (if only to remind myself), notwithstanding that huge volume spike off 8351, I am not wedded to this being a wave 4 up or a wave A. As long as price falls again, I'll be short and depending on where the price stops, will determine the count. What I don't want to be is long when it tumbles, but not too short too early!

Thursday, 23 October 2014

#dax $dax

Net longs banked at 9061; nudging short here. Will bank if looks corrective or add to shorts higher up if keeps going. Preference is for a corrective first, then add long again into the 9150+. Not a lot of room above without pushing the envelope, which in this momentum looks unlikely to me.

#dax $dax

Picked up some more longs there into 9030 - slow action backwards seems to suggest momentum remains up - will move to breakeven when hits 9089. I thought I'd post the 1hr, 2hr & 4hr charts along side each other. Note the ADX is bullish in all three, with the 4hr only really just crossing - that will need to kiss again in due course with the red, so that retracement is coming. However from where? Note that the 123.6% extension of blue 'a-b' on the 1hr chart is pretty much pip perfect with the 61.8% retracement from 9892 to 8351 on the 4hr. Price is at the regression median from the 9892 top on the 4hr, with the 50% retracement target a 'pop' above at 9121....pop and hold above would be bullish action again and likely to usher in the 61.8%. Note also the diagonal formation on the 2hr has popped and could actually be moving to the top of a parallel channel line, again at the 61.8% line. I just wonder, if it will now keep crawling up?

Picked up some more longs there into 9030 - slow action backwards seems to suggest momentum remains up - will move to breakeven when hits 9089. I thought I'd post the 1hr, 2hr & 4hr charts along side each other. Note the ADX is bullish in all three, with the 4hr only really just crossing - that will need to kiss again in due course with the red, so that retracement is coming. However from where? Note that the 123.6% extension of blue 'a-b' on the 1hr chart is pretty much pip perfect with the 61.8% retracement from 9892 to 8351 on the 4hr. Price is at the regression median from the 9892 top on the 4hr, with the 50% retracement target a 'pop' above at 9121....pop and hold above would be bullish action again and likely to usher in the 61.8%. Note also the diagonal formation on the 2hr has popped and could actually be moving to the top of a parallel channel line, again at the 61.8% line. I just wonder, if it will now keep crawling up?

Subscribe to:

Comments (Atom)