Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Monday, 30 September 2013

EURJPY

It has taken a little while to get positioned but the test downhill looks about ready to go. This is my profit for the day, so the deeper it goes, the better for me. If that strike up was a new trend in the 'e' wave up, then price should be held up by the opening ranges at the bottom of the screen and/or the green FLD. However, if this was a 'b' wave up in the ongoing correction downhill, then the fact that price is playing around under the daily pivot should have some bearing and price should just scythe through those barriers below. Watching the Dow 'not' bounce is adding to my confidence that my bearish count from the weekend is correct and we are in a wave 3 down, hopefully fuelling Yen strength in this pair.

EURJPY

That was a lot of energy. Longs closed at Daily Pivot. If this is a wave 2 up of 'c' in an ending diagonal, we should get one hell of a thrust down. Fingers crossed.

EURJPY

Well, give a couple of pips, that is the gap closed - still reckon that pattern looks like an expanding flat, so expecting falls here. We shall see.

USDJPY

It is the look of this pair and the 100% a=c extension target and time slice (blue dashed line to right) that along with the EURUSD has me on the defensive with EURJPY. Nothing here to suggest we are not going to get a slicing ending diagonal!

EURUSD

Looks like the count is working out just fine from Friday. Approx 1.3400 for the 'c' leg in wave 4 for RURUSD, and that will be roughly where I'll let my EURJPY shorts off the round trip. My target for EURJPY is 140.00, so getting in as low as possible will be a year changer for me, if it comes off.

EURJPY

Re-covered my longs again on that move out of the proposed diagonal. That now looks like an expanded flat for wave 4, now wave 5 down. Don't know but got to go with hunches sometimes and they have not been too bad of late. The London opening range high was 132.03, which was the highest out of Asian, London and US, so I'll see how any pull back reacts to that thrust through there.

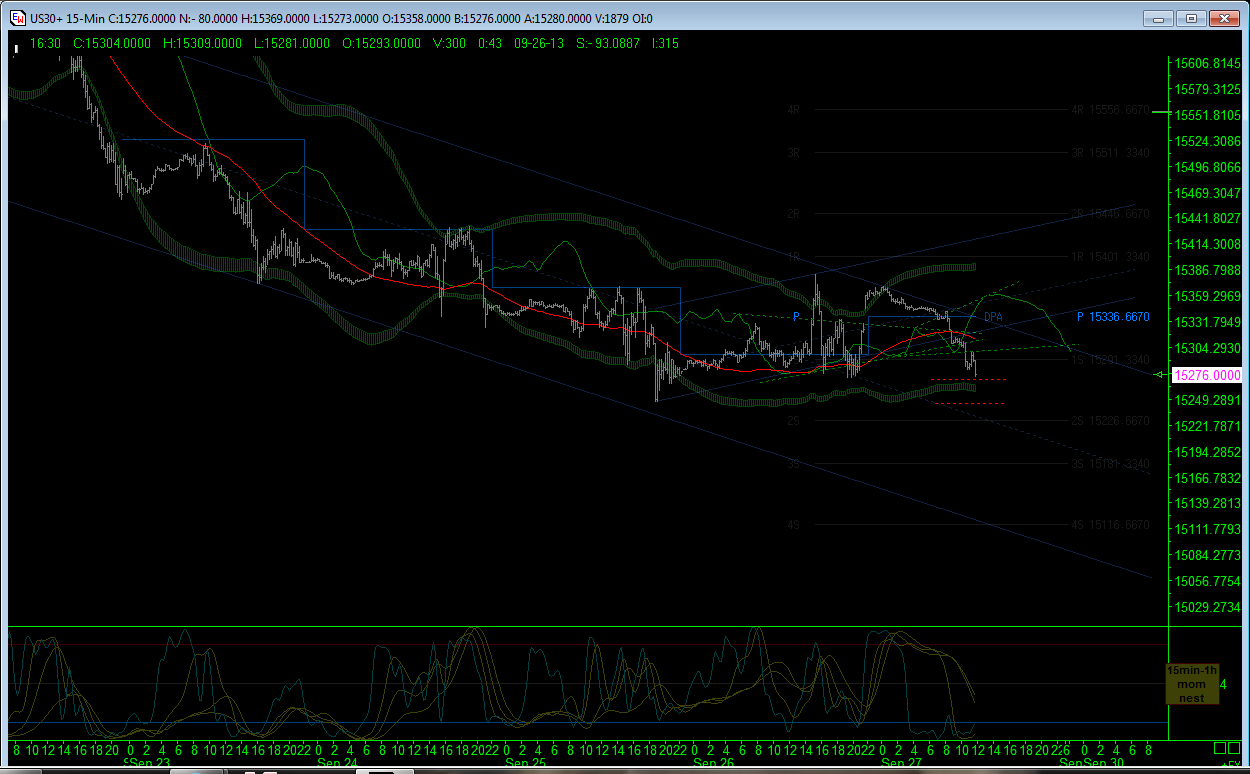

Dow Jones $indu

Following on from the weekend report, the 61.8% retracement line has been met and it is possible that we may see a little more gumption for a return journey to clarify the count. Of interest now to me, is whether the count is correct at 1-2 already or whether the 2 was in fact a 4. We shall see on the strength of the return.

EURJPY

Price action just about keeping above the Asian and London opening ranges at the moment. All relatively simple: we are waiting to see what the reaction to the drop is going to be. I was expecting a drop into this area or slightly lower last week but across all my charts there is an awful lot to be backtested at the daily pivot area, notwithstanding the bearish picture here, and the momentum studies look primed to help out. Thing is, if it gets there, it will have crossed the gap. Worth bearing in mind that the pink weekly trend line (of the daily pivot) is pointing uphill along with this regression channel. I'll be playing any further drops as a 'return to the mean' play.

Sunday, 29 September 2013

EURJPY

Busy day walking on the hills in probably the last days of sunshine for a while. So no full weekend summary for EURJPY (although I have done the Dow version - see right of of screen and last post) but here is a reminder of expectations as we get going. I had been hoping for a decline into the 'c' wave on Friday, but got frustrated at the lack of action into the early evening and covered my shorts. The gap down tonight looks like I got that wrong, but slept like a log this weekend and that is key too, I think - poor reward tonight though!! I'll be looking for a bottom tomorrow morning to buy into if price action looks right.

Dow Jones $indu Weekend Review

I'll begin this weekend by revisiting the Cyclic Phasing from the 2009 low. I have found the 100 day cycle (blue bars in sub-chart 1 and blue arrows in main chart) to be relatively stable and uniform. The number sequence 1-4, then providing easy at a glance phasing for the 200 day and 400 day cycles too, without having to draw additional bars - well I like it! I wanted to show this wide angle shot to emphasise the fact that we are in the 12th 100 day cycle since 2009 low, which amounts to being the 1200 day or 54month cycle due date for a low. These are big durations of course but this is the last 100 day cycle, so it can't be that far out can it? Based on the 11th cycle low, this 12th one should be the 23rd January, but I'll just take 'anticipated downward pressure' for now, out of this. Of interest is the 'cut' of the 400 day FLD in September 2009, marked with red arrows, and the subsequent touches since, also marked with red arrows. It seems to me that a test of this line might coincide with the 54month low, although a 'cut' to the downside might be just a little more interesting!!

I'll begin this weekend by revisiting the Cyclic Phasing from the 2009 low. I have found the 100 day cycle (blue bars in sub-chart 1 and blue arrows in main chart) to be relatively stable and uniform. The number sequence 1-4, then providing easy at a glance phasing for the 200 day and 400 day cycles too, without having to draw additional bars - well I like it! I wanted to show this wide angle shot to emphasise the fact that we are in the 12th 100 day cycle since 2009 low, which amounts to being the 1200 day or 54month cycle due date for a low. These are big durations of course but this is the last 100 day cycle, so it can't be that far out can it? Based on the 11th cycle low, this 12th one should be the 23rd January, but I'll just take 'anticipated downward pressure' for now, out of this. Of interest is the 'cut' of the 400 day FLD in September 2009, marked with red arrows, and the subsequent touches since, also marked with red arrows. It seems to me that a test of this line might coincide with the 54month low, although a 'cut' to the downside might be just a little more interesting!!In this closer view of the more recent price action, I have drawn in the VTL's (Hurst's Valid Trend Lines) that adjoin sequential peaks and troughs, for the 100 day cycle (1-3) and the 200 day cycle (4). First thing to notice is that the 100, 200 and 400 day trend lines are stacked to the downside (green below blue below gold!). This process from bullish to bearish has occurred whilst producing higher highs and higher lows. However, note how underneath this action, the thin green 100 day FLD was checked and then next the thin blue 200 day FLD, whilst producing those higher lows. Price is now sitting underneath the 100d FLD with the 200d FLD below. If price can cut this, then my thesis of the gold 400d FLD being the target line will be firmly on; even a retest of that last low will bring price under the blue 200d FLD. Now back to those VTLs: look at how line 1 provided a perfect backtest for the recent high. Line 2 joins the last 2 two troughs of the 100 day cycle, which is going downhill, notwithstanding the apparent significance of the higher lows in the Price Action. If price continues downhill from here, line 3 is also going to be validated and is going downhill steeper than line 2. We are also at the line 4, being the last two peaks joined for the blue 200 day trend line.Take out Friday's low and we are beneath that line too and I think we drop to 15000 very quickly.

Dropping down in timeframes, I pick up the nominal 80day, 40day and 20 day Hurst Cycles, which translate to 56, 28 and 14 trading days respectively, according to C.Grafton's work on the matter). By looking at how price reacts to the FLD peaks and troughs, it appears to me that the 80(56t) day cycle is the dominant one. As a matter of elimination, the price just wanders over the lower order troughs until an 80 day trough appears, and then reacts, not just on this screen shot, but for some time now. First things first then; the trend. Well, the 14day trend line is below the 28day which is below the 56 day. Add that to the 100/200/400 bearish stack above and going long is perhaps not a great strategy for now!! Price is sat right at the 28day blue FLD, which is corresponding with its cycle low (see sub-chart blue line). This may hold up price for a bit but as the 56day cycle appears to be the dominant one, I expect price to cut this line and continue down into the 80day trough, where the VTL's for both 28day and 56day trends sit. If price does cut this line, recall from the 2nd chart, that price will also be cutting the 200day blue VTL. I do not think price will be stopping at this bottom in due course, especially given the 56day low is someways off, but I'll worry about this later next month. We do have some divergence in the MACD & 6hr momentum study, so likely this 28 day FLD will cause a corrective pattern of some sort, but I am readying myself for a thrusting shot downhill when it is over.

On the 4hr chart, we can see the same divergence in the momentum cluster & MACD, but price is pushing on through the 4hr Ichimoku Cloud and both the daily 20 & 50SMA. Given the 28day FLD holding price up in the last chart, there is mounting evidence that anything less than a moon shot uphill, is going to end in some sort of collapse through this zone at some point soon.

Back to a daily chart and price is having a bearish go at this Ichimoku cloud too, but note the 45degree Gan Grid line sitting underneath it at approx 15100. The Gann Grid emanates from the 2012 hi/lo box, emphasised by the gold circles lower down, which I think has relevance to this year's action. That same area is also the 61.8% retracement zone of the move up from 14763. This would be an obvious place to put on another attempt at moving back higher, especially as the 50% line at 15242 is currently being tested with zeal. However, if it fails, then all the above holds.

So, here is the working chart. There is nothing bullish on here at all, and I am running with the very cheap 23.8% retracement in a wave 2, to fit my storyboard above. I'll start the week off with no trades on as I banked my shorts at 15205 Friday, and unless something completely off my radar northbound occurs, I'll be looking for short set ups on my 1min opening range charts that fit with the lower order FLD's here.

Friday, 27 September 2013

Dow Jones $indu

My longs are looking good already on the Dow off that low. Now just a teaser: most of that leg down was like pulling teeth. The second part of the leg, I guessed correctly as an expanded flat. Now, everyone including me was looking for an thinks they have found an ending diagonal and thank you very much too for the gains. But what if this horrible price action has actually been part of a larger expanded flat in leg 2 overall, where this leg down was in fact the 'c' leg of 'b'.Just saying because the internal expanded flat could be a fractal of what is to come. I am not going to mark it up, but I'll not be closing my longs prematurely, nor trying to catch a wave 5 down!!!!!

EURUSD & EURJPY

Just not shifting today. Have banked small gains on EURUSD from earlier today and covered the EURJPY going into the weekend. If I get a spike up on the Dow, I'll use the profits to clear everything out and start Monday fresh.

Dow $indu

Trying to buy this possible leg 3 bottom in a contracting diagonal. Momentum and PA suggest this is good place to look, anyhow.

Dow $indu

Possible contracting diagonal - looks like I banked on the nose there. I'll try and buy the 5th at about the 61.8% Monday I think.

Dow Jones $ Indu

Just closed longs there at 15205 - reckon this is in fact the ending diagonal I was trying to catch on Wednesday but got shafted - not this time baby! Leg 3 has a little more to go if it is leg 3 and then up and down again. Got to go pick up the kids, so banked that and see if I can catch something else later.

Dow $indu

I have to keep checking my data feed, this PA is almost non-existent. I got my shorts covered at BE, so whatever will happens is fine by me, but I'd prefer down to the 61.8% tonight to cover there instead! Nothing happening with opening range yet, so 2.30 GMT it is.

EURUSD

a=c for 'B' wave looks still good to me. Looking to short this on lower high. Very tight stop, enormous reward ratio if turns into 'C' down..... or more.

EURJPY

So, no surprise this has got itself stuck then. EURUSD rise this morning is counteracting USDJPY's fall. But, the price action is under key support, that it spent the lat two days getting to. So I am hopeful, that the EURUSD count will prevail and that it is a 'b' wave and not wave 5 up. If it is wave 5 up, and EURJPY can ride it out ranging, then I'll still get my drop to the bottom of the regression channel off the 134.935 high.

USDJPY

It is taking its time, but the 'c' of 'E' count I have been trying to blow embers on seems to be catching this morning. Again, if the EURUSD can stop messing around with the 'b' top I am assuming it is finishing, then together these two pairs should get my beloved EURJPY downhill too.

EURUSD

EURUSD

Price is back at that break out point again and trying to ruin my EURJPY shorts following the Dow (or maybe its all going up!). Could be a bullish count instead of my bearish one but I keep looking at the Dow and thinking, down for EURUSD would suit me better!!

Dow Jones $indu

Shorts are looking okay at the moment but we are at last night's lows and a push here would certainly help my cause. Everything a little hesitant at present but that is no 'up' direction this morning!

EURUSD

So far, so good here with what looks like a useful reversal to push down into a 'c' wave at least. Hopefully this will continue to put downward forces on EURJPY & the Dow which is what I am short in.

Dow Jones $ Indu

So that collapse yesterday occurred exactly at the lower threshold of the big gap up from two weekends ago now. I thought it might be a 'b' leg down but this action since suggests it might also count as an expanded flat in response. The dribble down of course does not yet fit with a 'wave 3 is underway', but if my currency pairs do print a 'c' wave down, then some softening here in' risk off' trade may work out fine. I'll stay short the Dow and wish for something chunky, although I very rarely seem to get a clear run with this index and it may just have been a 'b' leg as discussed.

EURUSD, USDJPY & EURJPY

These 3 pairs seem to be following the same basic premise: are we about to get going proper on this 'c' leg down or is there more procrastination on the cards, or am I just wrong! I'll just post the EURUSD count this morning to keep matters simple. I am looking for all 3 to drive downhill and set up the next leg higher. At the same time, I'd appreciate the Dow doing the same but me and that index seem to have an ongoing love hate relationship (I'd love to love it but it just keeps hating me!).

Thursday, 26 September 2013

Dow Jones $indu

Dow Jones $Indus

Well that Ending Diagonal did not work, but this rise up into the weekly pivot band is looking very 3 wavy at the moment and I wonder if something harder down ill is coming. I have taken the rise as an opportunity to lose my longs and see how the short side takes care of me and will worry about the possible count later once the next drop is in.

Dow Jones $indu Elliott Wave

I keep looking at this blessed chart and I am shifting the count again. The target at 15220 ish is still the same but given this slow start, I am going back to it being the 5th in 5 not 3. If you look at the MACD on the larger chart, it seems that there was a sneaky wave 4 in that mess earlier in the week that I thought might be a 'b' cluster. Anyhow, I'll chance my short cover off near 15210 in case we get deliverance northbound from there.

USDJPY

All the counts from this morning look to have nailed matters pretty well. Here is the updated count for USDJPY. The low in this 'c' of 'E' is likely to be the turning point for EURJPY too and the 'c' leg in the EURUSD retracement, so plenty of corroboration available. Got me thinking on how far the Dow has got to go though....uumm.

Dow Jones $indu

If the expanding diagonal turns out to be correct, legs 'iii' and 'v' are meant to be longer than each other an leg 'i'. Therefore we should see a cluster of bottoms in the 15200 area with possibly the 61.8% retracement target of 15129 being the markets goal. Gotta remember to take my shorts off somewhere down there, if this is how it pans out!

Dow Jones $indu

Not reckon that rise up is impulsive although it may become so. I have had another go at counting this drop and as ever, the longer it goes on, the clearer it perhaps becomes. I have shifted the count a little to accommodate a bit more room for a 5th to unravel, to fit with the Yen calcs from earlier. I have covered my longs here in case of a sharp 5th wave spike for 'Claims' day and hope to bank those and uncover my longs later today or tomorrow.

Subscribe to:

Comments (Atom)