Please make sure you have read my disclaimer! This is a personal journey into self-tutoring in technical analysis. Did you read that Disclaimer yet?

Disclaimer

Disclaimer: This blog should be read as a 'whiteboard' of my daily thoughts and ramblings and specifically not, in any way, advice to trade. My interpretation of the works of Gann, Goodman, Fibonacci, Elliott, Hurst et al; is entirely my own and should be read as such. Any opinions, news, research, analyses, prices, or other information contained in this report are provided as general market commentary, and does not constitute investment advice. I will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Saturday, 2 July 2016

Dax at resistance

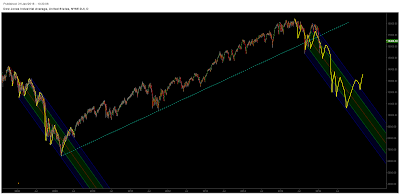

Interesting price action on the Dax on Friday. Could not help but notice the swings in commentary from negative to positive across my reading list, as price came up to the resistance line from 2014 and the 50% line in this Schiff Pitchfork study from the high.There has been so much energy around this resistance line, with price gaps since May aligned with emotional responses in the press.

I tweaked the StochRSI study to chime with the turns in price trend and noticed the similarity in patterns highlighted in yellow. Of course, they are somewhat distant cousins in size, but that was the interesting bit for me, when looking at the price action above.....it is more volatile and taking in greater distances. I like that Pitchfork study and the placement around the price action, but it will be somewhat easier with hindsight to determine direction from here; Friday's close seems to be another rest stop break!

Sunday, 3 April 2016

Dax monthlys

|

| Oscillators on monthly log scale more positive and little price decay since last screenshot whilst the first of the two oscillators holds. |

Saturday, 12 March 2016

A possible expanding diagonal on the monthly

Price has so far reacted positively to the first test of the weekly sma200, but a combination of technical studies on these longer range charts suggest there is more work to do to the downside. Whilst the weekly and monthly oscillators remains captive to their own trend lines, the 'wave 4 expanding diagonal' prognosis looks interesting, especially more so, if price fulfils that journey to set up wave 5.

Thursday, 4 February 2016

Dax weekly RSi looks poised but for what?

Sunday, 31 January 2016

Comparing Dow 2008 drop to current price action

Monday, 11 January 2016

Tuesday, 10 November 2015

Dax at support still

Dax sitting above median line between annual pivot at 9953 and R1 at 11552. Plenty of testing banked already above 10752 now on the 4hr chart, and RSi burning overbought conditions with price action in neutral. Could push on towards R1 if this support holds. Click text for chart.

Sunday, 18 October 2015

Dax review 18/10/2015

Last weekend's notes cover all points. 50% retracement line of last year's low to this year's high is at 10390 with the yearly mid pivot at 10752 (Pivot was 9953 backtested last week and R1 is 11552). If back test holds then those are my next two target points above.

Saturday, 3 October 2015

Dax Review 3/10/2015

This monthly chart shows the wave counts assumed to be in play. Whether this is wave 4 done, concluding, or if something more complicated pushing out to the right over the next few months (triangle) is to come, is perhaps the bigger picture question. Certainly the SMi setting being used, suggests we have only seen a single wave down thus far, comprised of an 'abc' through the weekly lens (see chart 3).

This monthly chart shows the wave counts assumed to be in play. Whether this is wave 4 done, concluding, or if something more complicated pushing out to the right over the next few months (triangle) is to come, is perhaps the bigger picture question. Certainly the SMi setting being used, suggests we have only seen a single wave down thus far, comprised of an 'abc' through the weekly lens (see chart 3).

The second monthly chart here focuses on the RSi study, which I posted during the week and clearly warns of a test of this down draft at the very least. Ignore the rest of the chart, which is meant for lower time frames. The previous RSi cycles at this degree, set off higher highs; whether this one will remains to be seen, but downside seems limited without a reset of some sort.

In this weekly chart, the annual pivots and their mid lines are in show. Breaching last year's low of 8354 will require price to push past the 78.6% retracement of the move out of that low and with the annual pivot at 9953, the current wave count assumed down from the top, the monthly RSi study in the last chart, and the weekly SMi study in this, chasing the downside may be painful for shorters who hang around too long. With three weekly candles attacking and holding above the 78.6% retracement at 9234 and the annual mid pivot of 9525, these aforementioned studies provide a platform for a test of the annual pivot at 9953, and then the higher 10752 and 11552 pivots initially.

The daily wave formation is of course bearish still, but those positive divergences in the RSi have me watching the lower order waves.

The two hour wave held firm on Friday with an interesting bounce out of daily S1 after the US announcements. Further ferreting of lower prices may still test this bullish wave, either compounding the positive divergences, or collapsing the wave. For now, looking to buy drops whilst the formation holds and keep an eye on the impact on the daily wave. Expect volatility to continue either way.

Tuesday, 29 September 2015

Friday, 28 August 2015

Dax: 200smas

|

| Ongoing wave 4 appears to be retracing with market asking if the drops are over yet. |

Friday, 14 August 2015

Dax Weekly Chart

Sunday, 19 July 2015

Dax Review 19th July 2015

|

| Monthly & Weekly charts: Given placement of monthly stochastics and continued negative direction of weeklys', I am staying with this count until the 4hr, below, softens |

|

| Daily & 4 hr charts: Perhaps an expanding triangle in a 'B' wave or maybe a new trend up as started. I'll sell down that 4hr stochastic and see where it lands. |

Friday, 17 July 2015

Wednesday, 8 July 2015

Dax 8th July 2015

Sunday, 5 July 2015

Dax Review 5th July 2015

Not a lot to add to my last counts; hardly had to move the legends. Looking for move down to breakout zone from combination bollingers near 10,000. Economic and political woes not seemingly having any impact on the overall counts. Check back in posts to see how bullish move after this drop should usher in a new high before a larger degree wave 4.

Friday, 19 June 2015

Dax Review 19th June 2016

Monthly & Weekly charts: assuming that this move down to 10500 zone is just a 'a' leg in blue wave 4. May turn into a triangle rather than this simpler pattern, but looking to buy 10400-10600 in a longer term uptrend, that does not look under any stress from this move back to the break out zone on the daily below

Daily chart shows the breakout zone being tested a little lower down and no signs of the pitchfork being broken to the upside as yet. Selling this lower into the buy zone and adding to that commitment on break up.

Daily chart shows the breakout zone being tested a little lower down and no signs of the pitchfork being broken to the upside as yet. Selling this lower into the buy zone and adding to that commitment on break up.

Sunday, 17 May 2015

Dax review 17th May 2015

Persistence of that weekly stochastic rolling down and the continued range bound price action suggests the blue Wave 4 may in fact be in play already. The negative divergence on the monthly chart, supports the red wave 5 being in already, although the lower order counts below look like another upside test is due.

The daily stochs look in need of upside relief and the 4hrly suggest this may have already begun late last week. I am looking for a move up to complete a red wave 'b' at about 12000 and then a move down to test that break out zone discussed in previous posts at around 10,000, unless something more complex starts to build. We will see how the weekly stochs look when that area is reached or become oversold earlier. Looks like we have a triangle in the middle of the red wave 'b' for now, so could be a slow start to the week.

Sunday, 10 May 2015

Dax Review 10th May 2015

The UK election results coincided with oversold stochastics on the 4hr chart and although the trend bands are still negative on that timescale, the 60 minute time frame and lower provided plenty of opportunities to go long on Friday. However, with overbought stochs on those timeframes and the 4hr trend band still downhill, a retest of that prior low may provide an opportunity to buy again or at the very least provide clarity on the strength of this move uphill.

The UK election results coincided with oversold stochastics on the 4hr chart and although the trend bands are still negative on that timescale, the 60 minute time frame and lower provided plenty of opportunities to go long on Friday. However, with overbought stochs on those timeframes and the 4hr trend band still downhill, a retest of that prior low may provide an opportunity to buy again or at the very least provide clarity on the strength of this move uphill.  Working right to left on the higher timeframes, we can see that the 8hr & daily stochs also appeared oversold, but again with downward facing trend bands. So at this level, the move up on Friday is either part of a retracement or the start of something bigger, in line with my red wave 5 count from last week into blue wave 3 top. If the pull back in the 4hr can hold the low and see the trend bands turn up, an oversold stochastics on the hourly chart after 3 waves down, could be a great place to go long with a secure low to play off. However, the positioning of those weekly and monthly stochastics, have me believing that the blue wave 3 top will see a decent pull back in due course, so new highs will see rigid stop losses! See previous posts for EW counts.

Working right to left on the higher timeframes, we can see that the 8hr & daily stochs also appeared oversold, but again with downward facing trend bands. So at this level, the move up on Friday is either part of a retracement or the start of something bigger, in line with my red wave 5 count from last week into blue wave 3 top. If the pull back in the 4hr can hold the low and see the trend bands turn up, an oversold stochastics on the hourly chart after 3 waves down, could be a great place to go long with a secure low to play off. However, the positioning of those weekly and monthly stochastics, have me believing that the blue wave 3 top will see a decent pull back in due course, so new highs will see rigid stop losses! See previous posts for EW counts.

Subscribe to:

Posts (Atom)